THE HINDU – CURRENT NOTE 02 February

Sidelights from Parliament

Sidelights from Parliament

Finance Minister Arun Jaitley announced that the country would mark the centenary of the Champaran satyagraha, led by Mahatma Gandhi, along with that of the Sabarmati Ashram.

Parties Indifference:

- TDP is happy that the capital gains tax has been waived on land being used for the construction of the new capital of Andhra Pradesh in Amaravati.

- BJD is upset that its demand for Rs. 5,780 crore has been reduced to an allocation of some Rs. 3,000 crore.

- Earlier, Telugu Desam Party and the Biju Janata Dal (BJD) have supported demonetisation move of govt.

A Budget for sustainable growth

A Budget for sustainable growth

This is a budget with three principle goals.

First:

- Reviving the flagging domestic investment by ramping up public capital expenditure by5% in the hopeto attract people’s private investment.

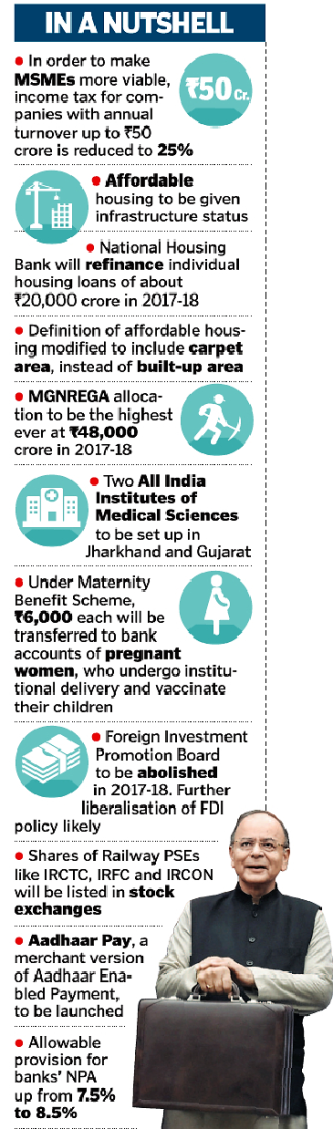

- Cutting corporate income tax rate from 30% to 25% for SMEe with an annual turnover of less than Rs. 50 crore.

- Taking further steps in improving the ease of doing business.

Second:

- Requirement for urgently generating a large number of employment opportunities for the increasingly restive youth.

- The massive push to affordable housing with its vast backward linkages in the economy and high employment intensity will contribute to achieving this goal.

- The special package for textiles and some other labour-intensive sectors will also help as will the enhanced allocation to infrastructure sectors. The tax relief for SMEs will also help.

Third:

- It aims at cleansing the economy of black money flows and illegal incomes, thereby sharply squeezing the scope and space for the parallel economy.

- The enactment of the Benami Properties and Illegal Income Acts and demonetization, the budget has announced a direct attack on the fountainhead of political corruption by reducing the amount of individual donations to political parties to a paltry Rs. 2,000, as recommended by the Election Commission.

New initiatives

- Rather inefficient practice of ‘vote on account’ will be avoided and the finance bill will now be approved by the end of the present fiscal year.

- The somewhat spurious and dysfunctional distinction between plan and non-plan expenditure has been done away with, which will permit a clearer distinction between the share of capital and revenue expenditure.

- It is pertinent to note here that by allowing fiscal deficit to rise to 3.2% of the GDP in 2017-18 while bringing down revenue deficit to 1.8% (instead of 2% as recommended by the FRBM committee), the FM has displayed commendable sagacity and responsibility towards the priority of promoting investment and employment.

Income Tax relief for Rs. 2.5-Rs. 5 lakh slab

Income Tax relief for Rs. 2.5-Rs. 5 lakh slab

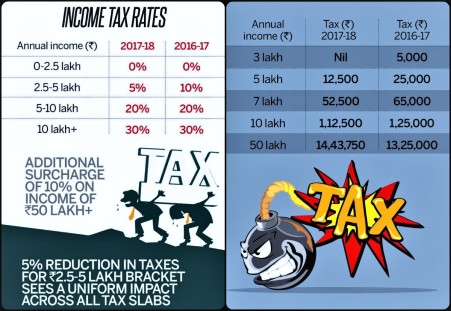

- Reducing the tax rate to 5% from 10% for income below Rs. 5 lakh and at the same time reducing the rebate from tax to Rs. 2,500.

- The combined effect of the reduced tax rate and the rebate of Rs. 2,500 will mean that those earning up to Rs. 3 lakh a year will effectively see their tax liability fall to zero (a tax incidence of Rs. 2,500 at 5% of Rs. 50,000 minus the rebate of Rs. 2,500).

- Those earning between Rs. 3 lakh and Rs. 3.5 lakh will have a tax liability of Rs. 2,500 (a tax incidence of Rs. 5,000 minus a rebate of Rs. 2,500).

- The total tax foregone on account of these measures is Rs. 15,500 crore.

Fiscal resolve may pave way for rate cut

Fiscal resolve may pave way for rate cut

- Resolve for maintaining fiscal discipline, now on the Reserve Bank of India’s court to take a cue and lower interest rates further.

- The fiscal deficit target at 3.2% for the next financial year which is lower than what the market expecting.

Key facts:

- The committee which was set up to review fiscal responsibility and budget management (FRBM) has favoured debt to GDP of 60% by 2023, as compared to about 66% now, consisting of 40% for Central Government and 20% for State Governments.

- Within this framework, the Committee has derived and recommended 3% fiscal deficit for the next three years.

- The new fiscal roadmap also gives the Centre an escape clause (allowing a deviation of up to 0.5% of GDP) in case of far reaching structural reforms with unanticipated fiscal implications.

Lower interest rate:

- Targeted a fiscal deficit of 3.2% which is lower than our forecast of 3.5%. Expect RBI to cut policy rates by 25 bps with the finance minister pursuing fiscal consolidation. On balance, expect banks to cut average lending rates by 50-75 bps by September.

- Since January 2015, the central bank has reduced the repo rate by 175 bps points. Though banks were initially reluctant to reduce lending rates, but after the demonetization exercise which helped the banks to reduce cost of funds, they reduced lending rates sharply from the beginning of January.

Committee report:

The report also notes that the Finance Minister’s decision not to fully utilize the escape clause provided by the FRBM committee, even if there was disruption caused by demonetisation, and keeping the deficit at 3.2% was disappointing, given the need for propping up both public investments and consumption momentum.

‘Lost continent’ lies under Indian Ocean

‘Lost continent’ lies under Indian Ocean

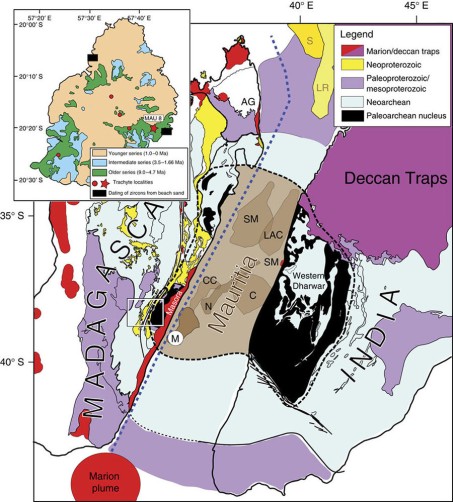

- Scientists have confirmed the existence of a “lost continent” under the Indian Ocean island of Mauritius that was left over by the break-up of the super-continent, Gondwana, which started about 200 million years ago.

- The piece of crust, which was subsequently covered by young lava during volcanic eruptions on the island, seems to be a tiny part of ancient land that broke off from the island of Madagascar, when Africa, India, Australia and Antarctica split.

- Earth is made up of two parts — continents, which are old, and oceans, which are “young”. On the continents, you find rocks that are over four billion years old, but you find nothing like that in the oceans, as this is where new rocks are formed.

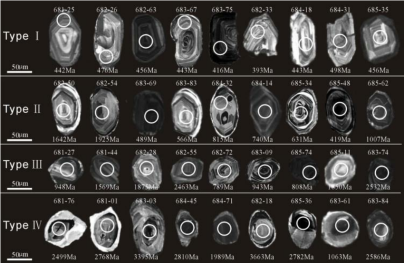

- Mauritius is an island, and there is no rock older than nine million years old on the island. By studying the rocks on the island, zircons are found that are as old as three billion years.

- There are much older crustal materials under Mauritius that could only have originated from a continent. A study done in 2013 has found traces of the mineral in beach sand.

About Zircons:

- Zircons are minerals that occur mainly in granite from the continents. They contain trace amounts of uranium, thorium and lead, and due to the fact that they survive geological processes very well, they contain a rich record and can be dated extremely accurately.

Study Concerns:

- The mineral could have been either blown in by the wind, or carried in on vehicle tyres or scientists’ shoes. The ancient zircons in rock (six million-year-old trachyte), corroborates the previous study and refutes any suggestion of wind-blown, wave-transported or pumice-rafted zircons for explaining the earlier results.

- There are many pieces of various sizes of “undiscovered continent”, collectively called “Mauritia”, spread over the Indian Ocean.

- According to the new results, this break-up did not involve a simple splitting of the ancient super-continent of Gondwana, but rather, a complex splintering took place with fragments of continental crust of variable sizes left adrift within the evolving Indian Ocean basin.