What is the issue?

Around 136 countries have signed an agreement at the OECD meeting to redistribute taxing rights and impose a global minimum corporate tax on large MNCs operating globe over.

What is the need for a global minimum corporate tax rate?

- Large MNCs have traditionally been taxed based on where they declare their profits rather than where they actually do business.

- This allowed several large companies to shift their profits to low-tax jurisdictions (tax havens).

- This has led to significant decline in Global corporate tax rates since the 1980s to well below 25% in 2020.

- The double taxation avoidance agreements have been exploited by using the mismatches between the tax laws of various countries.

- The COVID-19 pandemic has also severely battered economies and affected the tax revenues of governments.

What does the new agreement say?

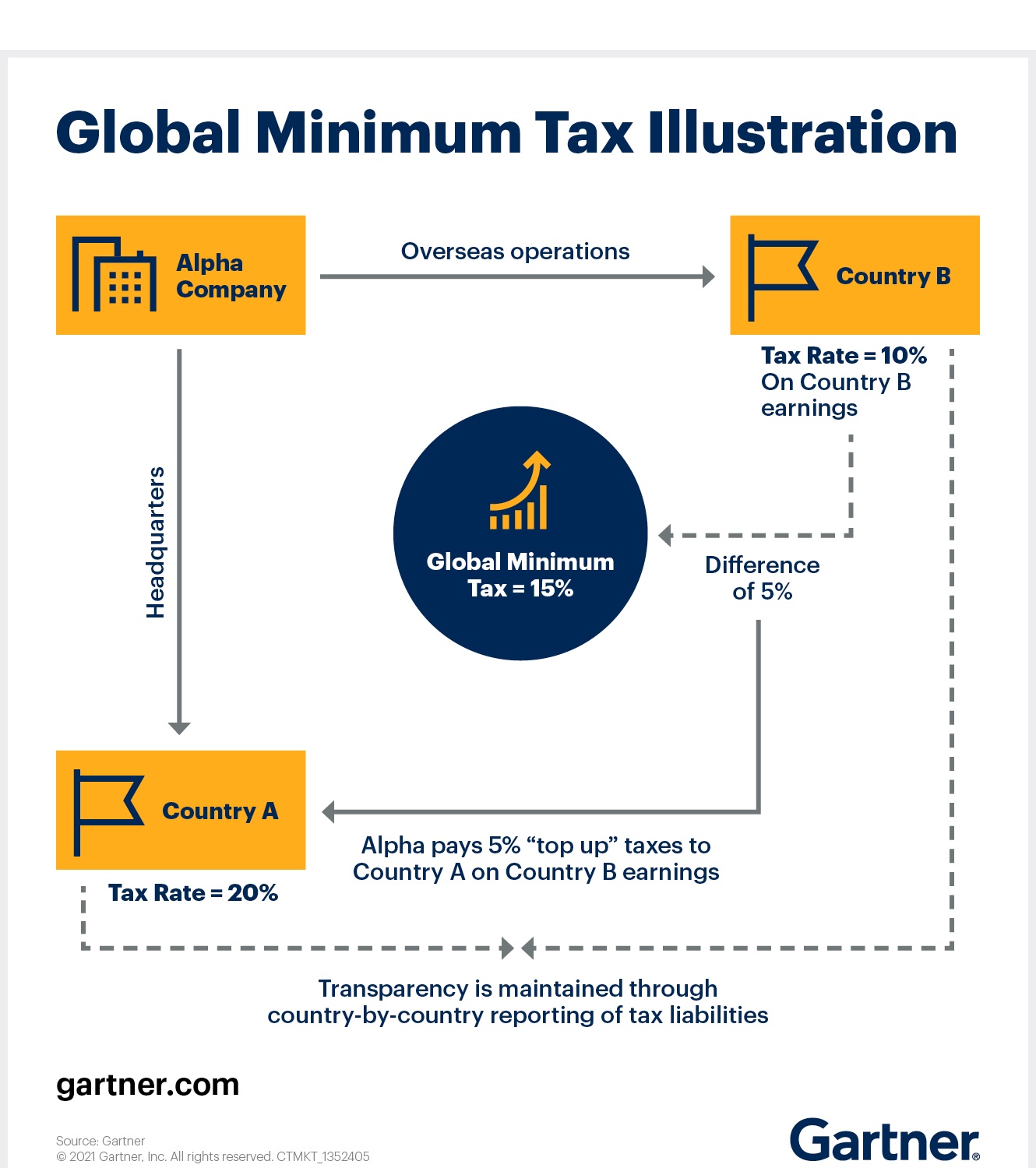

- The agreement fixes the corporate tax rate at 15% on large MNCs across the world.

- It let the governments to impose a top-up tax on home companies that pay lower than 15% tax on profits they declare abroad thus adding additional annual revenues to the budgets of governments.

- The deal also allows a government to impose top-up taxes on the subsidiary of a foreign company if it declares profits through its home headquarters in a different country and pays less than 15% taxes on those profits.

- This prevent companies from profit shifting to tax havens.

India, China, Russia, Germany and other countries have signed the agreement, which has to be implemented from 2023.

What measures have been taken earlier to prevent tax evasion?

- Digital Services Tax- Countries like Belgium, Britain, India and Indonesia brought in Digital Services Taxes on the local sales of foreign firms with online platforms.

- Equalisation levy – Based on the recommendations of Akhilesh Ranjan Committee in 2016, India became the first country to implement the equalisation levy

- It was levied at 6% on online advertisement services earned by non-residents and at 2% on e-commerce operators.

What are the expected benefits?

- The agreement will stop the countries racing against each other to cut taxes to attract businesses.

- It will increase the tax revenues and help governments invest in social development.

What are the challenges in the agreement ?

- Oxfam International has criticised the deal, arguing that the minimum corporate tax rate of 15% is too low.

- Some view that it may hamper the various economic benefits that come with tax competition among countries.

- The so-called tax havens such as Ireland, Switzerland, Bermuda etc. are defended as they benefit citizens of high-tax countries.

- Higher taxes in the home countries will suppress the ability of the companies to serve the consumers in their countries.

- India would have to reconsider the equalisation levy and address issues such as the share of profit allocation and the scope of subject-to-tax rules.

- Simultaneous implementation of the law by all the signatories will be a tedious process.

- India’s Direct Tax Code has to be revamped in accordance with the concept of global minimum tax.

- Th agreement if achieved may herald the dawn of the ‘Golden Era’ of direct taxes.

Source: The Hindu